How Bynder helps brands during M&A

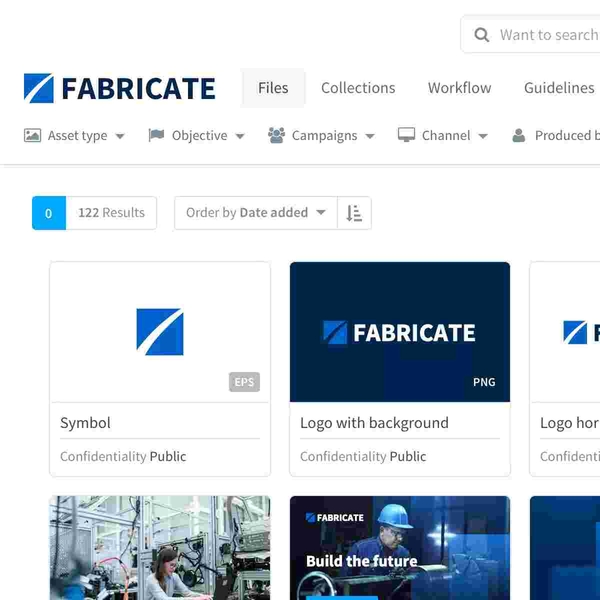

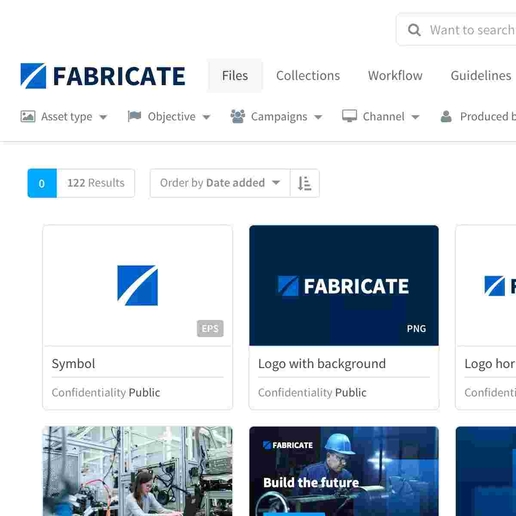

No time wasted looking for brand assets

- M&As can be a messy process, and it’s all too easy to slip into content chaos where no one knows where content is, who it belongs to, and how it should be used.

- Centralize assets in one brand portal

- Give the right stakeholders access to the right content

- Rebrand or refresh with ease

Streamline communication across organizations

- Quickly create and sign off on new branding components and campaign materials

- Always have the right stakeholders involved in review and approval rounds with workflow presets

- Push new brand assets to your DAM upon approval

Get your designers in the fast lane

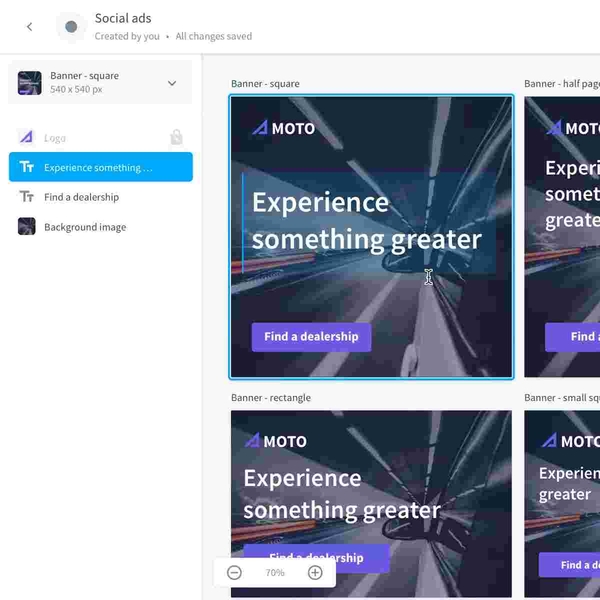

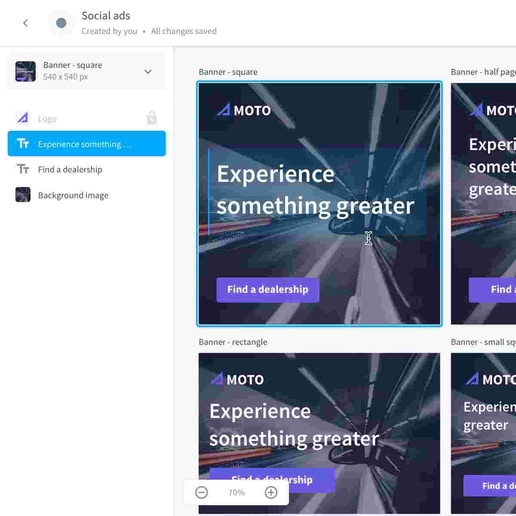

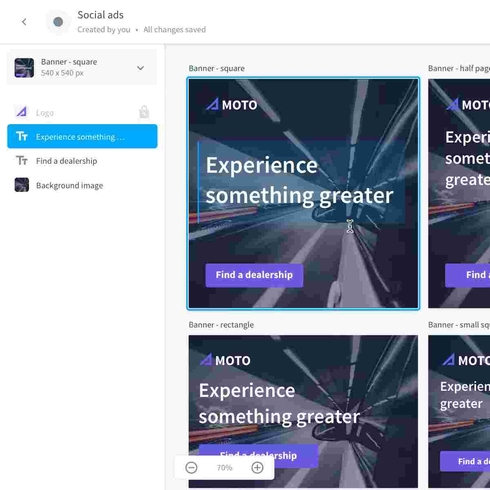

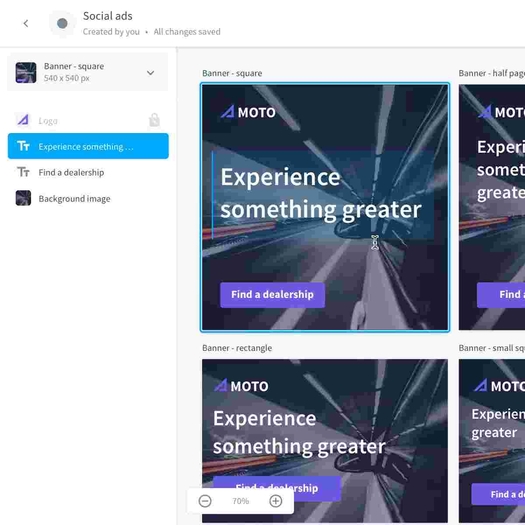

Sounds odd in the middle of a merger? After all, new Google ads, Instagram, Facebook, Twitter and Linkedin banners all had to be done by yesterday. Not to mention they also need to be localized across markets.

- Enable designers to focus on the creative process of branding during M&A with brand templates

- Fix elements to maintain brand consistency

- Speed up and scale up asset creation for print, digital and video content

Let marketers get their hands dirty

- Scale content production by easily creating hundreds of banners

- Help marketers create more content quickly while sticking to design principles, ensuring consistency and enabling faster time to market

- Upload new versions or files to the DAM replacing outdated materials where needed

Get your content out there

- During M&A, processes need to be merged and branding content needs to be updated across internal and external channels

- Share collections created from your DAM and share with internal or external stakeholders

- Provide the guidance on how to use your brand elements and assets with Brand Guidelines

- Use Bynder’s API to automatically update assets across channels

What is a merger and acquisition?

A “merger” is often used to describe two entities voluntarily combining forces to create a new company, with the mutually-beneficial end goal of expanding market share and boosting bottom-line revenue.

On the other hand, an “acquisition” is usually a less equal affair, with typically one larger entity taking over a smaller entity via its financial power, often incorporating the smaller entity’s assets and employees into its existing business—without creating a new “combined” company.

These days, the distinctions between the two terms are frequently blurred, due in part to many companies referring to what is actually a hostile “acquisition” as a “merger” instead, given the former term’s negative associations.

Why do companies need digital asset management during the merger and acquisition process?

The merger & acquisition process is an exercise that many underestimate. The rebranding process is more than a simple updating of a logo and website. It includes a lot of extra marketing work on top of business as usual. From updating websites, integrating data and systems, to revamping content and company messaging, there’s a lot to consider.

Companies undergoing a merger & acquisition need to ensure that their brand and the value they provide customers are both clearly and consistently articulated following the merger & acquisition process. This can be a period of rapid change for organizations, and they often have to contend with a lot of digital assets—both old and new—as part of the rebranding and consolidation process. This can inevitably be a chaotic affair without the right processes, tools, and appropriate communication channels in place.

By having a central location to manage brand operations and the digital assets of both entities, digital asset management for companies in the midst of a merger or acquisition allows for better transparency, communication, and consistency for branding and marketing assets during a time of rapid change.

The end result of leveraging digital asset management during M&A is a more structured, coordinated rebranding launch, and ultimately more trust and confidence with their customers by providing consistent brand experiences across all digital touchpoints.

What problems does digital asset management help solve for companies undergoing a merger & acquisition?

Disorganized, decentralized digital assets

A common issue facing companies right after the initial merger & acquisition is having company assets spread out and disorganized across multiple file-storage solutions and harddrives, stifling the ability to effectively audit everything, and preventing marketing and sales teams from quickly finding the files they need.

By leveraging digital asset management such as Bynder as a single source of truth for brand operations, teams can communicate better, inspire marketing efforts across global markets via self-sufficiency, and easily share content with teams outside of the marketing department such as sales and finance. With smart filters and a file taxonomy that matches the company “lingua franca”, stakeholders know exactly how to locate and use digital assets.

Rebranding struggles

When two organizations are merging systems, processes, and people, there are even more opportunities for miscommunication. Whether they’re communicating internally across newly merged companies, or communicating externally to PR and agencies, showcasing a strong brand story is important. If not, organizations may lose credibility and the confidence and trust of their customers.

Integrating Brand Guidelines functionality within the digital asset management suite (such as with Bynder) can significantly help prevent these issues by functioning as a “digital home” for a newly-rebranded identity, providing a central place to communicate design principles, mission statements, instructions on creating branded assets, and more.

By ensuring simple accessibility that is also easy to update, key stakeholders know exactly how the rebranded company should be communicated for better brand consistency and clarity.

To learn more about the benefits of digital asset management for companies undergoing an M&A, check out our guide: How Bynder helps marketing teams tackle M&A-triggered rebranding activities.

Suggested content for mergers and acquisitions initiatives

Curious how Bynder can help your initiative?

Our in-house experts can walk you through everything you need to know.

Book a demo Free 30-day trial